TL;DR

UK landlords face various risks, from legal disputes to tenant issues. This guide outlines practical strategies to protect yourself legally and financially, including managing risks, staying compliant, and securing reliable income.

What’s in This Article:

- How Landlords Can Protect Themselves: Legal and Financial Strategies

- Legal Tips for UK Landlords

- Ensuring Tenancy Agreements Are Watertight

- Staying Compliant with UK Landlord Laws

- Documenting Communications with Tenants

- Financial Protection Strategies for Landlords

- Securing Reliable Rental Income

- Understanding Landlord Insurance Options

- Planning for Unexpected Costs

- FAQs About Landlord Protection

How Landlords Can Protect Themselves

Being a landlord in the UK comes with rewards, but it also involves risks. From legal disputes to financial challenges, landlords must be proactive in safeguarding their investments and protecting themselves from potential pitfalls.

This guide offers practical tips for landlords to protect themselves legally and financially while maintaining a smooth rental operation.

Legal Tips for UK Landlords

Adhering to legal best practices is one of the most effective ways landlords can protect themselves from disputes and penalties.

Ensuring Tenancy Agreements Are Watertight

A clear and legally sound tenancy agreement sets the foundation for a successful landlord-tenant relationship. Include the following:

- Rent payment terms and due dates.

- Property maintenance responsibilities for tenants.

- Clear rules on property usage, such as no-smoking policies.

Tip: Consult a property law expert to ensure your agreement aligns with UK regulations.

Staying Compliant with UK Landlord Laws

Non-compliance with landlord laws can lead to fines, legal action, or tenant disputes. Key compliance areas include:

- Right-to-Rent Checks: Verify tenants’ eligibility to rent in the UK.

- Deposit Protection: Secure deposits in a government-approved scheme like DPS or MyDeposits.

- Safety Regulations: Meet requirements for gas, electrical, and fire safety.

Documenting Communications with Tenants

Keep a written record of all tenant interactions, including:

- Repair requests and responses.

- Notices served for inspections or rent reviews.

- Agreements made during disputes.

These records can provide crucial evidence if disputes escalate to legal proceedings.

Financial Protection Strategies for Landlords

Landlords can secure their income and property investments by adopting proactive financial strategies.

Securing Reliable Rental Income

Consider options like a landlord guaranteed rent scheme to ensure consistent payments, even during void periods or tenant arrears.

Guaranteed Rent Programme – Explore how guaranteed rent protects landlords’ income.

Understanding Landlord Insurance Options

Landlord insurance provides coverage for unexpected events. Policies may include:

- Building Insurance: Protects against structural damage.

- Contents Insurance: Covers furnishings in furnished rentals.

- Rent Guarantee Insurance: Covers unpaid rent during tenant disputes.

Tip: Compare policies to find the best fit for your property and circumstances.

Planning for Unexpected Costs

Create a contingency fund to cover emergency repairs, legal fees, or tenant defaults. Experts recommend setting aside at least 10% of annual rental income for unforeseen expenses.

FAQs About Landlord Protection

Landlords must provide a gas safety certificate, an Energy Performance Certificate (EPC), and the government’s How to Rent Guide at the start of the tenancy.

Clear communication, detailed tenancy agreements, and prompt responses to tenant concerns can help minimise disputes.

While not legally required, landlord insurance is highly recommended to protect against unexpected financial losses.

Protect Your Investments with Proactive Strategies

Landlords in the UK face various challenges, but by staying compliant, managing risks, and securing financial protection, you can safeguard your investments and maintain peace of mind.

Citywide Housing offers expert advice and tailored property management solutions to help landlords minimise risks and maximise returns.

Contact Us Today – Learn how Citywide Housing can support UK landlords.

Share

Latest posts

The Benefits of Choosing a Guaranteed Rent Scheme

How a Rent Guarantee Scheme Protects Your Rental Income

Essential Landlord Tips for Managing Properties Effectively

Did you enjoyed this article?

Join our email mailing list to receive weekly tips, industry insights + more.

Discover Relevant Articles and Resources

HMO landlords in 2026: why this year is a turning point

TL;DR HMO landlords face tighter regulation, higher compliance costs, and increased scrutiny in

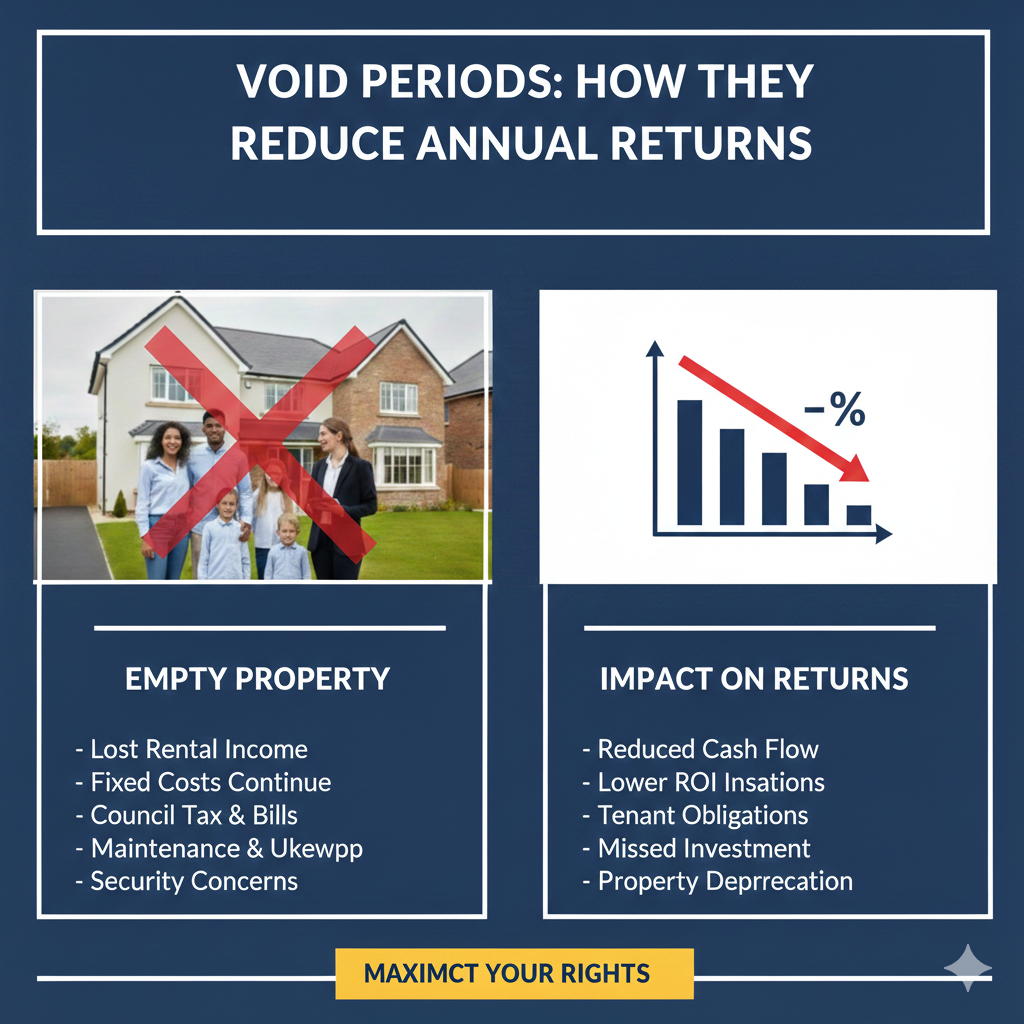

Void periods: how they reduce annual returns

TL;DR Void periods directly reduce annual rental returns. Even short gaps between tenancies

Long-term leases: do landlords lose control?

TL;DR Long-term leases do not remove ownership control. Instead, they transfer day-to-day management

Ready to Secure Your Guaranteed Rent?

Fill out the form for a free consultation call and let us take care of your property, hassle-free.