TL;DR

Converting your Bradford HMO to supported housing provides guaranteed rental income, removes tenant management responsibilities, and protects you from upcoming regulatory changes. Most conversions require minimal property modifications and can be completed within 4–6 weeks.

Is Your Bradford HMO Suitable for Supported Housing?

Not every HMO qualifies, but most do.

Properties that work well:

3–6 bedroom terraced houses in Bradford, Shipley, or Keighley

Properties with separate bedrooms and shared facilities

HMOs already meeting basic safety standards

Well-maintained properties in residential areas

What housing providers look for:

Valid HMO licence (or licence-ready)

Fire safety compliance

Adequate bedroom sizes (typically 6.51m² minimum)

Functional kitchen and bathroom facilities

If your property currently lets to students or professionals, it’s likely suitable for supported housing.

What Changes Are Needed to Convert?

Most Bradford HMOs need minimal modification.

Typical requirements include:

Updated fire detection systems

Emergency lighting installation

Clear fire escape routes

Safety certificates (gas, electrical, EPC)

Property condition meeting the Decent Homes Standard

Many landlords already meet these requirements for their HMO licence.

The housing provider typically handles any additional modifications needed for specific occupant needs.

How the Conversion Process Works

Converting to supported housing follows a straightforward process:

Week 1–2: Initial Assessment

Property inspection by housing provider

Compliance review

Lease terms discussion

Week 3–4: Documentation

Lease agreement drafted

Safety certificates verified

Any minor works identified

Week 5–6: Completion

Final inspections

Lease signed

First rent payment processed

Most landlords are receiving rent within 6 weeks of initial contact.

What Happens to Your Existing Tenants?

This depends on your tenancy agreements.

If you have periodic tenancies:

You can serve notice as normal and transition once the property is vacant.

If you have fixed-term agreements:

Most landlords wait until the natural tenancy end before converting.

If you want to convert immediately:

Some housing providers can facilitate early transitions, though this requires cooperation from existing tenants.

Planning ahead makes the transition smoother.

How Rent Is Calculated for Supported Housing

Supported housing rent is agreed upfront based on:

Property location and condition

Number of bedrooms

Local rental market rates

Length of lease agreement

Typical Bradford rates (2026):

3-bed HMO: £1,200–£1,500/month

4-bed HMO: £1,600–£2,000/month

5-bed HMO: £2,000–£2,500/month

These figures are guaranteed monthly, regardless of occupancy.

Compare this to private letting where:

Voids can cost 1–2 months’ rent annually

Arrears risk averages 5–8% of landlords

Management fees run 10–15% of rent

Supported housing eliminates these variables.

Read more:

Property Management for Supported Housing in West Yorkshire: What Landlords Really Need

Why Bradford HMO Landlords Are Converting Now

The timing makes sense for several reasons:

Regulatory pressure is increasing:

Section 21 abolition removes eviction certainty

HMO licensing is becoming stricter

Compliance costs are rising

Market conditions favour long-term stability:

Tenant churn is increasing

Void periods are lengthening

Rent collection is becoming harder

Supported housing solves both issues:

One tenant (the housing provider)

No voids between occupants

Professional compliance management

For many Bradford HMO landlords, conversion is becoming the logical choice.

What Property Management Support Do You Need?

Even with supported housing, landlords benefit from specialist management.

Key services include:

Lease coordination with housing providers

Ongoing compliance monitoring

Property maintenance oversight

Acting as a single point of contact

This isn’t the same as traditional letting agent services. The focus is on long-term asset management, not tenant finding.

Common Concerns About Converting HMOs

“Will I earn less rent?”

Possibly slightly less than peak market rent, but with no voids, arrears risk, or management costs, net income often increases.

“What if I want to sell?”

Supported housing leases are typically assignable, and some buyers prefer properties with guaranteed income already in place.

“Can I switch back to private letting?”

Yes, once the lease term ends. Most agreements are 3–5 years.

“What about property damage?”

Housing providers and management agents handle property care. Damage beyond normal wear and tear is their responsibility.

Is Converting Your Bradford HMO Right for You?

Consider conversion if you:

Want predictable monthly income

Prefer hands-off management

Are concerned about upcoming regulatory changes

Own an HMO that meets basic compliance standards

Supported housing isn’t suitable for landlords planning short-term property sales or those requiring maximum rental yields at any cost.

For landlords prioritising stability, compliance, and long-term income, conversion makes strategic sense.

Next Steps for Bradford HMO Landlords

To explore conversion:

Review your property’s current compliance status

Calculate your net income under private letting vs supported housing

Contact specialist supported housing property managers

Request a property assessment

Most conversions begin with a no-obligation property review.

Ready to discuss converting your Bradford HMO to supported housing?

Book a Free Consultation

Share

Latest posts

The Benefits of Choosing a Guaranteed Rent Scheme

How a Rent Guarantee Scheme Protects Your Rental Income

Essential Landlord Tips for Managing Properties Effectively

Did you enjoyed this article?

Join our email mailing list to receive weekly tips, industry insights + more.

Discover Relevant Articles and Resources

HMO landlords in 2026: why this year is a turning point

TL;DR HMO landlords face tighter regulation, higher compliance costs, and increased scrutiny in

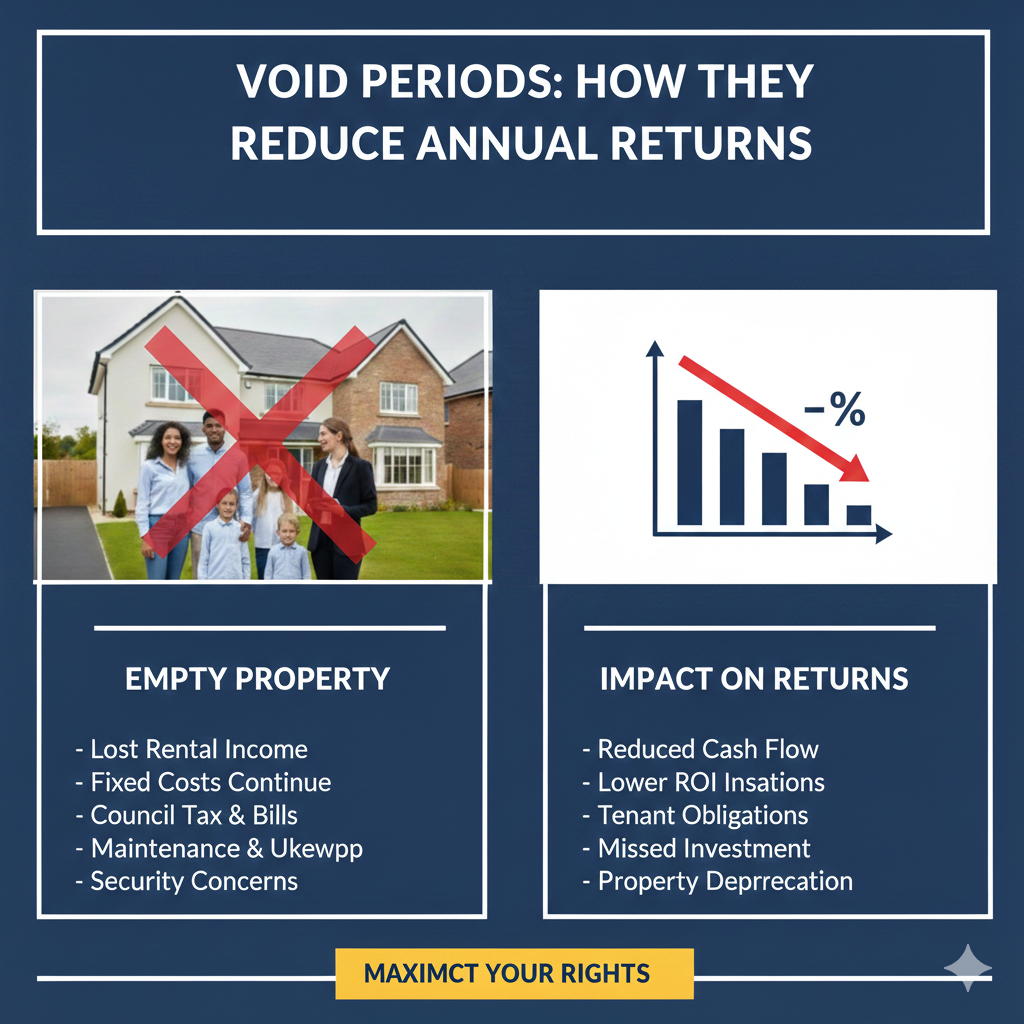

Void periods: how they reduce annual returns

TL;DR Void periods directly reduce annual rental returns. Even short gaps between tenancies

Long-term leases: do landlords lose control?

TL;DR Long-term leases do not remove ownership control. Instead, they transfer day-to-day management

Ready to Secure Your Guaranteed Rent?

Fill out the form for a free consultation call and let us take care of your property, hassle-free.