TL;DR

Bradford landlords using guaranteed rent typically achieve 85–95% of market rent but eliminate voids, arrears, and management time. When factoring in hidden costs, guaranteed rent often delivers higher net income with significantly less work

The Real Cost of Traditional Letting in Bradford

Most landlords focus on headline rent figures without calculating true net income.

A typical 3-bed Bradford terrace renting for £850/month:

| Cost Factor | Annual Impact |

|---|---|

| Gross rent (100% occupancy) | £10,200 |

| Agent fees (12%) | -£1,224 |

| Average void period (4 weeks) | -£850 |

| Maintenance and repairs | -£600 |

| Tenant finding fees | -£300 |

| Legal cover and insurance | -£180 |

| Net income | £7,046 |

This assumes:

- No arrears

- No major repairs

- Only one tenancy change

- No compliance issues

In reality, most landlords experience at least one of these annually.

How Guaranteed Rent Changes the Calculation

Using the same property under guaranteed rent:

3-bed Bradford terrace with guaranteed rent at £750/month:

| Income/Cost | Annual Impact |

|---|---|

| Guaranteed rent | £9,000 |

| Voids | £0 |

| Arrears | £0 |

| Tenant finding | £0 |

| Day-to-day management | Minimal |

| Net income | £8,400–£8,700 |

You’re receiving £100 less per month in gross rent, but £1,350–£1,650 more in net annual income.

Why?

- Zero void periods

- No tenant turnover costs

- No arrears risk

- Minimal time investment

Bradford Market Rent vs Guaranteed Rent: Typical Rates

Realistic 2026 comparisons for Bradford properties:

2-bed terrace:

- Market rent: £650–£750/month

- Guaranteed rent: £600–£650/month

- Net advantage: Guaranteed rent (when voids and costs factored in)

3-bed semi-detached:

- Market rent: £850–£950/month

- Guaranteed rent: £750–£850/month

- Net advantage: Break-even to slight guaranteed rent advantage

4-bed HMO:

- Market rent: £1,600–£1,800/month

- Guaranteed rent: £1,400–£1,600/month

- Net advantage: Guaranteed rent (significantly lower management burden)

The gap narrows or reverses once you account for:

- Void periods (typically 3–6 weeks annually)

- Agent fees (10–15%)

- Maintenance coordination time

- Arrears and legal costs (affecting 8–12% of landlords annually)

What Traditional Letting Doesn't Show You

Bradford landlords using traditional letting face hidden costs beyond the financial.

Time investment per property annually:

- Viewings and tenant selection: 6–10 hours

- Maintenance coordination: 8–15 hours

- Rent chasing and tenant communication: 5–20 hours

- Compliance and safety checks: 4–6 hours

Total: 23–51 hours per property per year

For landlords with multiple properties or full-time jobs, this time cost is substantial.

Guaranteed rent reduces this to:

- Quarterly inspections: 2–3 hours

- Annual compliance review: 1–2 hours

Total: 3–5 hours per property per year

When Traditional Letting Still Makes Sense

Guaranteed rent isn’t always the better option.

Stick with traditional letting if:

- Your property is in a very high-demand area (e.g., Bradford city centre, near university)

- You can reliably achieve 98%+ occupancy

- You have efficient systems for tenant management

- You’re willing to actively manage tenancies

- You enjoy the hands-on aspect

Some landlords genuinely prefer direct control and are willing to accept the time and risk trade-off.

When Guaranteed Rent Makes More Sense

Guaranteed rent works better for Bradford landlords who:

- Own properties in moderate-demand areas (Shipley, Keighley, Queensbury)

- Have experienced void periods exceeding 4 weeks

- Want to reduce time spent on property management

- Are concerned about upcoming Renters’ Rights Act changes

- Prefer predictable cash flow for mortgage or tax planning

For these landlords, the reduction in gross rent is offset by:

- Eliminated voids

- Removed arrears risk

- Reduced management time

- Long-term income certainty

The Impact of the Renters' Rights Act on This Comparison

From 2026 onwards, traditional letting becomes more complex:

Changes affecting traditional landlords:

- No more Section 21 evictions

- Periodic tenancies as standard (increasing churn risk)

- Stricter compliance enforcement

- Higher legal costs for possession proceedings

These changes don’t affect guaranteed rent arrangements because:

- Your tenant is the housing provider (a commercial entity)

- Occupancy management isn’t your responsibility

- You’re operating under a commercial lease, not residential tenancy

This regulatory divergence makes guaranteed rent increasingly attractive for risk-averse landlords.

Real Bradford Landlord Example: Side-by-Side Comparison

Case study: 4-bed semi-detached in Shipley

Traditional letting (2023–2025):

- Market rent: £1,100/month

- Gross annual income: £13,200

- Agent fees (12%): -£1,584

- Void period (6 weeks, 2024): -£1,650

- Rent arrears (3 months, 2025): -£3,300

- Legal costs recovering arrears: -£800

- Net 3-year income: £27,066 (£9,022/year average)

Guaranteed rent (2026 onwards):

- Guaranteed rent: £950/month

- Annual income: £11,400

- Minimal management

- Zero voids or arrears

- Projected 3-year income: £34,200 (£11,400/year)

Net difference: £7,134 more over 3 years with guaranteed rent

This landlord switched in early 2026 specifically to avoid future tenancy issues.

How to Decide What's Right for Your Bradford Property

Calculate your true net income:

- Take your annual gross rent

- Subtract agent fees (or value your time at £20–£30/hour if self-managing)

- Subtract realistic void periods (Bradford average: 4–6 weeks)

- Subtract average maintenance and emergency repair costs

- Subtract tenant finding fees

- Factor in arrears risk (even 1 month every 3 years matters)

Compare this to guaranteed rent offers:

Most Bradford landlords find guaranteed rent at 85–90% of market rate delivers equal or higher net income with significantly less involvement.

What Happens If You Want to Switch Back?

Guaranteed rent agreements are typically 3–5 years.

If circumstances change:

- You can return to traditional letting when the lease expires

- Some agreements include break clauses

- Properties with guaranteed rent history often attract buyers seeking income stability

You’re not locked in permanently, but most landlords who switch don’t go back.

Common Misconceptions About Guaranteed Rent

“You’re leaving money on the table”

Only if you ignore voids, arrears, and time costs. Most landlords earn more net income with guaranteed rent.

“The property will be damaged”

Guaranteed rent properties are professionally managed with regular inspections. Damage beyond fair wear and tear is the provider’s responsibility.

“You lose control”

You retain ownership and asset value. You’re simply changing who manages occupancy and day-to-day issues.

“It’s only for problem properties”

Many landlords switch their best-performing properties to guaranteed rent for stability and reduced management burden.

Final Calculation: Is Guaranteed Rent Worth It for You?

Ask yourself:

- What is your true net income after all costs?

- How much time do you spend per property annually?

- How important is income certainty vs. maximum gross rent?

- How concerned are you about upcoming regulatory changes?

For most Bradford landlords, guaranteed rent delivers:

- Similar or better net income

- 90% less management time

- Zero void or arrears exposure

- Protection from regulatory complexity

The trade-off is typically 10–15% lower gross rent, which is offset by eliminated costs and risks.

Next Steps:

- Calculate your current true net income per property

- Request a guaranteed rent quote for comparison

- Factor in your time value and risk tolerance

- Make an informed decision based on real numbers

Book a Free Property Assessment to see what guaranteed rent could look like for your Bradford property.

Want to compare guaranteed rent vs traditional letting for your specific property? Book a Free Consultation

Share

Latest posts

The Benefits of Choosing a Guaranteed Rent Scheme

How a Rent Guarantee Scheme Protects Your Rental Income

Essential Landlord Tips for Managing Properties Effectively

Did you enjoyed this article?

Join our email mailing list to receive weekly tips, industry insights + more.

Discover Relevant Articles and Resources

HMO landlords in 2026: why this year is a turning point

TL;DR HMO landlords face tighter regulation, higher compliance costs, and increased scrutiny in

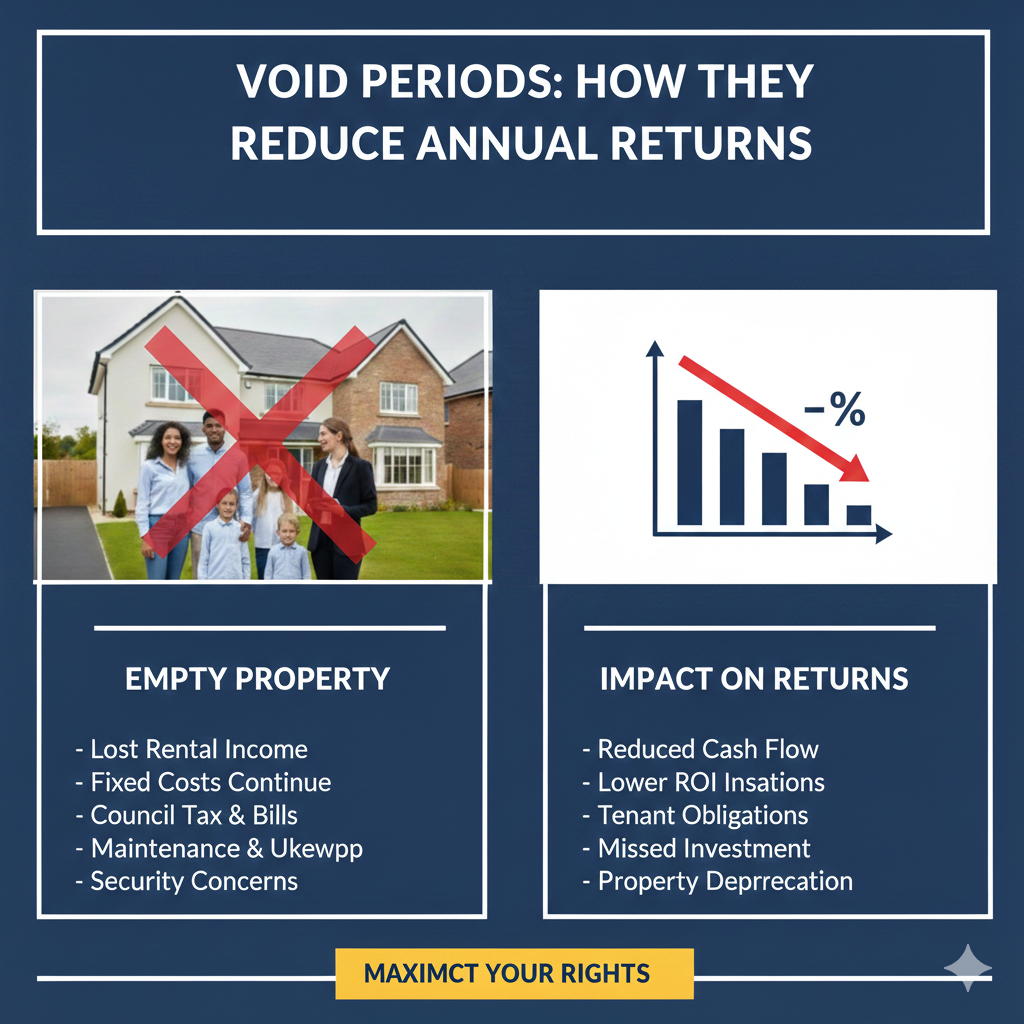

Void periods: how they reduce annual returns

TL;DR Void periods directly reduce annual rental returns. Even short gaps between tenancies

Long-term leases: do landlords lose control?

TL;DR Long-term leases do not remove ownership control. Instead, they transfer day-to-day management

Ready to Secure Your Guaranteed Rent?

Fill out the form for a free consultation call and let us take care of your property, hassle-free.