If you own a rental property, you’ve probably heard of rental yield. But what does it really mean, and how can you make sure yours is as good as it should be?

Let’s break it down in simple terms, with easy examples and real solutions.

What is Rental Yield?

Rental yield is the amount of money you make from renting out your property, compared to how much the property is worth. It’s usually shown as a percentage.

Here’s a quick example:

Let’s say you bought a property for £150,000

You rent it out for £750 a month, which is £9,000 a year

Rental Yield = (Annual Rent ÷ Property Price) x 100

Rental Yield = (9,000 ÷ 150,000) x 100 = 6%

A 6% yield is pretty solid. But some landlords manage 7–9% or even higher!

Why Does Rental Yield Matter?

The better your rental yield, the more return you’re getting on your investment. If your yield is too low, you may struggle to cover mortgage payments, maintenance, and other costs — let alone make a profit.

How Can You Increase Your Rental Yield?

1. Choose the Right Location

Some cities offer much better rental returns than others. For example:

Sunderland and Liverpool are currently seeing yields around 8.5%.

London, while more expensive, often has much lower yields due to high property prices.

2. Add Value to the Property

Simple upgrades can justify a higher rent:

Add an extra bedroom or bathroom

Install modern kitchen or appliances

Offer fast broadband and smart home features

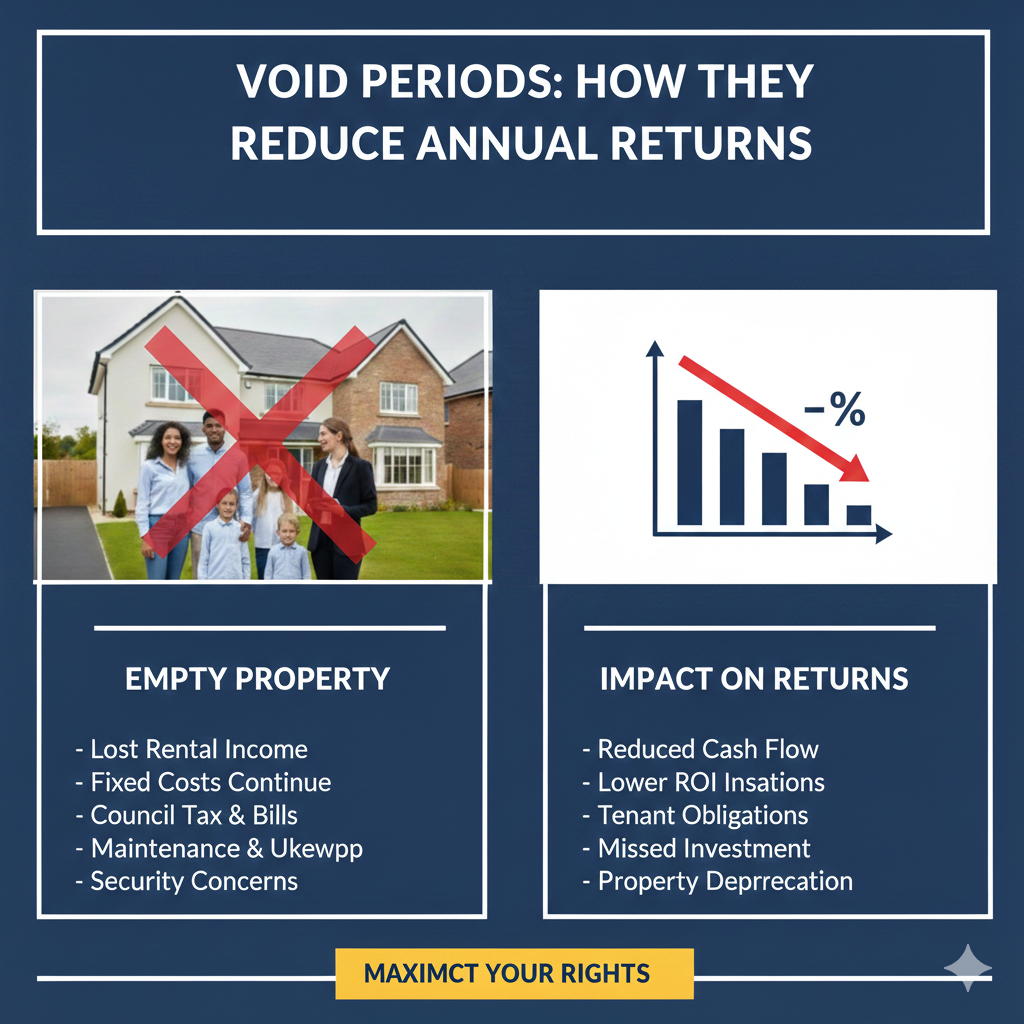

3. Avoid Voids at All Costs

Every empty month is money lost. Make your property appealing, respond quickly to enquiries, and retain good tenants so they renew their lease.

4. Use a Guaranteed Rent Scheme

With Citywide Housing’s Guaranteed Rent Scheme, landlords receive consistent rent every month, even if the property is empty or the tenant misses a payment.

Here’s an example:

Property value: £140,000

Monthly guaranteed rent: £800 (£9,600 a year)

Rental yield = (9,600 ÷ 140,000) x 100 = 6.86%

Frequently Asked Questions About Rental Yield (with Examples)

1. What’s a good rental yield in the UK?

A good rental yield is generally between 5% and 8%.

Example:

Buy a house for £180,000

Rent it out for £950/month = £11,400/year

Rental yield = (11,400 ÷ 180,000) x 100 = 6.33%

2. How do I calculate rental yield if I have a mortgage?

You can still calculate gross yield the same way, but if you want net yield, you subtract your yearly expenses (mortgage, insurance, maintenance) from your annual rent before dividing.

Example:

Annual rent: £10,200

Annual costs: £3,200

Net yield = (10,200 – 3,200) ÷ property price x 100

On a £160,000 property = 4.38% net yield

3. Does high rental yield mean better profit?

Not always. A high yield is good for cashflow, but if property value doesn’t rise, you may miss out on long-term capital gains. It’s about balance.

Why Are Landlords Targeting 11% Rental Yield?

You might hear landlords talk about wanting an 11% rental yield. Here’s why:

- Better Cashflow: An 11% yield usually means the property pays for itself (and then some). It’s especially attractive to landlords without capital growth in mind.

- Financial Cushion: With higher yield, you can absorb more expenses — like repairs or mortgage increases — without it hurting your profits.

- Ideal for Portfolio Landlords: If you own multiple properties, strong rental yield helps keep your overall portfolio profitable.

Example of an 11% Yield:

- Property price: £90,000

- Monthly rent: £825 → Annual rent = £9,900

- Rental yield = (9,900 ÷ 90,000) x 100 = 11%

How do you achieve this?

- Buy in lower-cost areas like parts of Bradford or South Yorkshire

- Let to multiple tenants (HMOs) or run the property as serviced accommodation

- Work with providers like Citywide Housing who offer consistent rent through guaranteed rent schemes

It’s not easy to get 11%, but with the right property and setup, it’s possible.

Rental Yield in West Yorkshire, South Yorkshire, Bradford, Leeds, and Manchester

These regions have consistently been among the best for landlords looking for strong rental yields.

West Yorkshire

Locations like Leeds, Wakefield, and Huddersfield offer solid yields, typically ranging between 6%–8%. Leeds city centre has high tenant demand due to its student and young professional population.

South Yorkshire

Cities like Sheffield and Doncaster are known for affordable property prices and good returns, with average yields around 6.5%–7.5% in many parts.

Bradford

Bradford offers one of the best entry points for investors, with properties under £100k and yields often exceeding 8% in certain areas like Manningham and BD5. In the right scenario, yields can hit 10–11%.

Leeds

Leeds has a diverse rental market — city centre flats, student lets in Headingley, and family homes in suburbs. Yields vary from 5.5% to 8% depending on location.

Manchester

A hotspot for both capital growth and yield, Manchester averages around 6%, with areas like Salford and Ancoats often pushing above 7% due to regeneration and rental demand.

How Citywide Housing Group Supports Landlords

At Citywide Housing Group, we specialise in helping landlords secure guaranteed income with long-term leases. Our approach ensures:

Full Property Management: From tenant management to maintenance, we take care of everything so you don’t have to.

Compliance and Legal Support: We ensure that all your properties meet legal requirements and comply with housing standards.

No Hidden Fees: We believe in transparency, with no surprise costs—what we agree on is what you get.

Local Expertise: Our team is familiar with the Leeds housing market, ensuring you get the best returns for your property.

FAQs About Guaranteed Rent for Leeds Landlords

Our leases typically last between 3 to 5 years, offering landlords long-term stability.

Even if your property is vacant, you will still receive guaranteed rent payments.

Yes, you can sell your property at any time, but your guaranteed rent payments will continue until the end of the lease agreement.

Contact us for a free property assessment and see how our guaranteed rent scheme can benefit your Leeds property.

How to Get Started with Citywide Housing Group

If you’re ready to secure fixed, reliable income with no voids or arrears, it’s time to join the growing number of landlords benefiting from guaranteed rent schemes.

Contact Citywide Housing Group today to schedule your free property assessment and discover how we can help you unlock the potential of your property.

For more information, visit Citywide Housing or call us at 0113 323 0678.

Share

Latest posts

The Benefits of Choosing a Guaranteed Rent Scheme

How a Rent Guarantee Scheme Protects Your Rental Income

Essential Landlord Tips for Managing Properties Effectively

Did you enjoyed this article?

Join our email mailing list to receive weekly tips, industry insights + more.

Discover Relevant Articles and Resources

HMO landlords in 2026: why this year is a turning point

TL;DR HMO landlords face tighter regulation, higher compliance costs, and increased scrutiny in

Void periods: how they reduce annual returns

TL;DR Void periods directly reduce annual rental returns. Even short gaps between tenancies

Long-term leases: do landlords lose control?

TL;DR Long-term leases do not remove ownership control. Instead, they transfer day-to-day management

Ready to Secure Your Guaranteed Rent?

Fill out the form for a free consultation call and let us take care of your property, hassle-free.